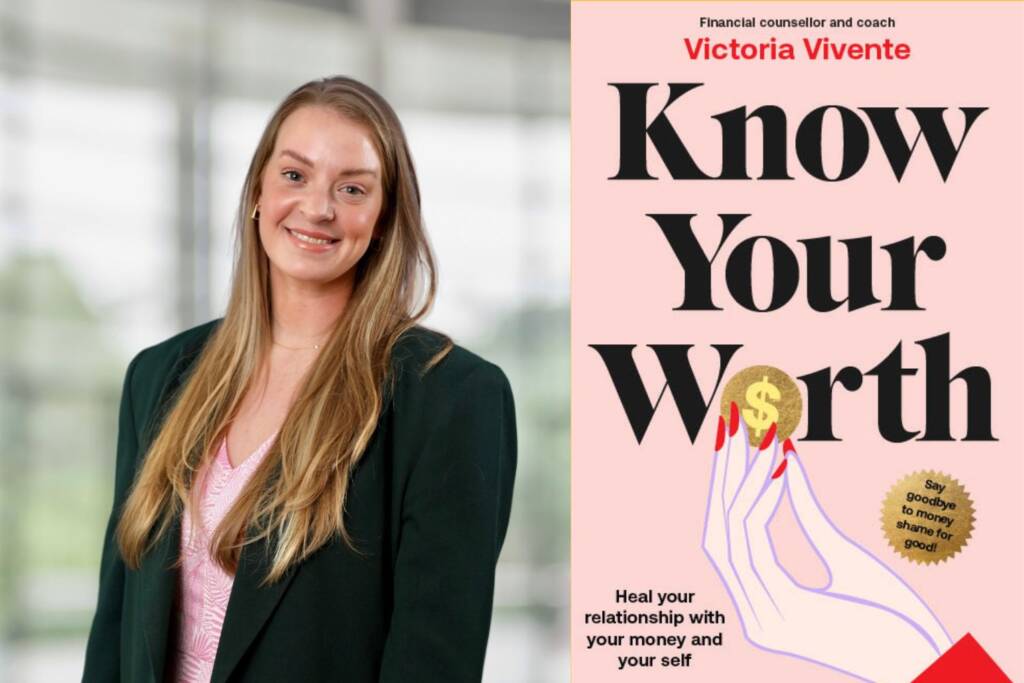

Words by Victoria Vivente

Steal my foolproof hack for becoming unpopular at dinner parties: just bring up any one of my two favourite topics—shame or superannuation. Trust me, if you are looking for a quick and easy way to lose friends and alienate people, a conversation about one of those topics will do it.

Steal my foolproof hack for becoming unpopular at dinner parties: just bring up any one of my two favourite topics—shame or superannuation. Trust me, if you are looking for a quick and easy way to lose friends and alienate people, a conversation about one of those topics will do it.

Shame is a universal experience—we’ve all felt that unmistakable prickle of heat wash over us. I could walk into any room and ask people to share a moment they felt shame, and they’d instantly have an example. It’s because shame often colours some of our most defining experiences, leaving its mark in ways we can’t forget.

Shame comes in all forms, from the ‘old shames’—like coming last in the primary school cross-country (me) or being the only one left in the office after school, not invited to lunch (also me)—to the ‘big shames’ of adult life: getting fired, ending a relationship, or staying in one long after you know you shouldn’t (me, me, and me). Then there’s the shame tied to things beyond our control but that somehow feels like our fault. The eating disorder from my 20s that never fully disappeared. The sexual assault I wondered if I somehow invited (I didn’t). It’s that quiet, insidious shame we’d never blame someone else for, but in our own minds, it festers in the dark.

Money shame is a strange kind of shame. Some aspects fall into the ‘big shame’ category—filing for bankruptcy, losing a house, defaulting on a personal loan. But it also shows up in ‘small shame’ moments: feeling like we’re not where we should be or that everyone else has somehow pulled ahead while we’re still stuck. It might be the $4,000 credit card that’s always near its limit, a secret we’ve never shared. Or the way our bank account dips into the red the day before every payday. These little things quietly gnaw at us, even if no one else notices.

It doesn’t really matter if we are carrying money shame that comes from big things, small things, or both. The feelings – that we should have known better, or done better, or that everyone else has learned money lessons that we’ve missed – are the same.

Can I let you in on a secret? It’s not just you. Money shame doesn’t discriminate. I’ve worked with lawyers, electricians, bankers, government workers, receptionists, teachers, film directors, and retirees. Everyone has money baggage they are carrying around. You’d be amazed at the money secrets people keep. But then again, would you? After all, we all have money secrets.

One of the biggest issues is how we stay silent about money. It’s signing mortgage documents without reading the fine print because we don’t fully understand it—but hey, everyone does it, so it must be fine. It’s putting off learning about superannuation because it feels complicated and not urgent. And since it’s been around for most of our lives, we’re embarrassed to admit we don’t understand it, even though most of us were never really taught how it works.

As a qualified financial counsellor, people often assume I’ll judge them for their money decisions—what they’ve spent their money on, what they don’t understand, or the mistakes they’ve made. But nothing could be further from the truth. The problem isn’t what they’re spending on; it’s why they feel their money decisions deserve judgment. More often than not, there are plenty of financial strengths in their behaviour—they just don’t recognise them in themselves.

While this is a whole-of-society issue, there are still ways of healing individual money shame. Firstly, by giving yourself permission to gently question yourself on why you interact with money in a particular way, and understanding that the shame we feel about ourselves or things that have happened to us in life are interwoven with our money shame – they impact each other. Our money behaviours don’t exist in a vacuum.

Secondly, seek out stories that remind you you’re not alone. Sharing our money mistakes—whether we bounced back or just learned some hard lessons—is a powerful way to realise that everyone else is just doing their best too.

Finally, find a way to build those foundational money skills you might’ve missed or never learned in a way that made sense to you. Look for flexibility, simple explanations that don’t require a PhD, and maybe even a bit of fun. Whether that’s through podcasts, social media or books, whatever works for you. Find voices that resonate with the way you think, and voices that don’t judge you for how you feel.

On the other side of money shame is money joy. The journey might be messy and take time, but it’s worth it for the peace it brings. May 2025 be the year you put aside the new year’s resolution, and instead make a new year’s commitment to working through your shame without judgement, and healing your relationship with your money and yourself. You deserve that peace.

Know Your Worth is out now through Affirm Press.